Buying Final Expense?

Well, That's All We Do, Final Expense!

Scroll Down To Get Your Instant Quote Now!

Protect Your Loved Ones By Buying Final Expense!

Don’t leave your loved ones with financial stress while they’re grieving. Funeral costs aren’t optional — someone will have to cover them. Take action today and give your family the peace of mind they deserve.

Before You Get Your Instant Preliminary Quote, Let's See How Insurance Quotes Work! And What You Should Know!

First, How Insurance Companies Work

Insurance companies are in the business of making money. Every decision they make—from pricing to approval—is based on the personal information they gather about you. They will offer a final quote only after they have completed their research about your health and lifestyle.

The Companies We Use

We work with trusted, lesser-known insurance carriers that don’t spend millions on advertising. That means lower

overhead—and lower prices—for you.

The Big-Name Brands

The companies you see on TV and at sports events spend a fortune on marketing. Guess who pays for that? Their customers—through higher premiums.

Why Do I Get A Preliminary Quote and Not a Final quote?

Because insurance companies haven’t yet reviewed your full health

and lifestyle details. Until then, they can’t make a final offer.

Remember: If they can’t assess the risk, they won’t offer coverage.

How Do I Get My Own Instant Preliminary Quote?

Scroll Down To The Green Button "Get Your Instant Preliminary Quote Here"

Learn How To Use The Instant Preliminary Quote App?

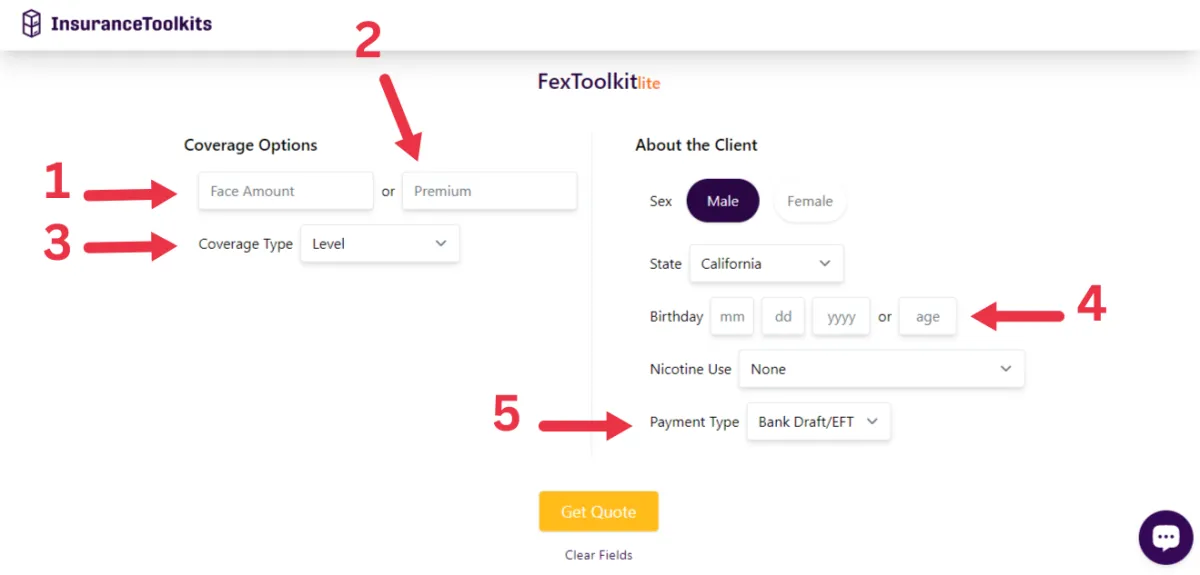

1. Face Amount:

Face Amount: How much coverage would you like for funeral and related costs? Most insurance companies offer up to $25,000–$30,000 in coverage for final expenses such as funeral, burial, and other end-of-life costs. Higher amounts may be available if you qualify.

Or (Pick either the Face Amount or Premium)

2. Premium:

How much can you comfortably afford to pay each month? The more premium you can afford, the more coverage you can get. Get what you are comfortable with.

3. Coverage Type: (Optional)

You can skip this step for now, and leave it at "Level" which is the default option. But here's what each of the 4 options means:

A. Level: (Under Coverage Type Dropdown)

Full coverage from day one. Fixed premium. Best rates for healthy individuals.

B. Graded/Modified: (Under Coverage Type Dropdown)

Limited payout in the first 2 years (e.g., 30%–70%). Full coverage after that. For those with moderate health

concerns.

C. Guaranteed Issue: (Under Coverage Type Dropdown)

No health questions. Everyone qualifies. Full coverage starts after a 2-year waiting period during which you

will continue to make full premium payments every month.

D. Limited Pay: (Under Coverage Type Dropdown)

Pay off your policy in 10, 15, or 20 years — but keep coverage for life. No payments in retirement.

4. Age:

Numbers only. For example, 40, 41, 70, 72, etc.

5. Payment Type:

Choose how you'd like to pay each month:

A. Bank Draft/EFT (Best Option): (Under Payment Type Dropdown)

Pulled from your checking account. No extra fees and lowest premium. Preferred by most insurance

companies.

B. Direct Express: (Under Payment Type Dropdown)

For government benefit cards. Accepted by some companies, but not all.

C. Debit Card: (Under Payment Type Dropdown)

May add a small monthly fee and increase your premium in most cases.

D. Credit Card(Least Preferred): (Under Payment Type Dropdown)

Often comes with extra fees and may raise your premium. Also risks missed payments.

All Other Fields Are Self-Explanatory And Required.

Congratulations! Now You Have Your Preliminary Quote!

Next Step. Schedule A Call To Complete Your Application.

Final Expense Insurance

Ease the burden on your family during difficult times with our Final Expense Insurance, covering funeral and other end-of-life expenses.

Testimonials

⭐⭐⭐⭐⭐

“At my age, it’s all about protecting my family. This policy will handle everything when the time comes, and that’s a big relief.”

— Leonard J., 66, Visalia, CA

⭐⭐⭐⭐⭐

“It’s not easy thinking about these things, but I wanted to handle it myself—not leave it to my daughter. This was the right move.”

— Carolyn T., 52, Modesto, CA

⭐⭐⭐⭐⭐

“I just wanted something simple that wouldn’t leave my kids scrambling. This gave me peace of mind without costing a fortune.”

— Angela M., 54, Fresno, CA

⭐⭐⭐⭐⭐

“I’ve seen too many people leave their families with bills. I didn’t want that to be me. This coverage makes sure I don’t.”

— James L., 62, Sacramento, CA

⭐⭐⭐⭐⭐

“I didn’t think I’d qualify with my health history, but they worked with me and made it easy. I feel relieved knowing this is taken care of.”

— Katherine R., 58, Bakersfield, CA

Frequently Asked Questions

Common Questions Answered for your convenience.

Q: What is Final Expense insurance?

A. Final Expense insurance is whole life insurance, typically in smaller amounts ($15,000–$25,000), made to cover funeral and burial costs. It never expires, builds cash value, and is usually approved quickly—with faster payouts than traditional policies, often within days of filing a claim.

Q: How much coverage do I need?

A: Varies based on a number of factors, like what city and state you live in, at what age you buy the policy, what options you select for your funeral services. In California, a full-service funeral and burial can cost $10,000–$15,000 or more now. It 10 year it will be more. Most people choose $15,000 to $25,000 in coverage to account for these expenses and any last bills.

Q: Do I need a medical exam to qualify?

A: No medical exam is required. Most plans just ask a few health questions and can offer same-day approval based on your answers.

Q: How fast does coverage start?

A: The plans we offer provide full coverage from day one—as long as you can answer a few basic health questions.

In contrast, guaranteed issue policies, offered by top brand name insurance companies on TV and social media (with no health questions) come with a 2-year waiting period. If the insured passes away during that time, the beneficiary typically receives just a refund of premiums plus interest, not the full death benefit.

Q: How much does it cost per month?

A: For a $15,000 policy, non-smokers in their 50s–60s typically pay $60–$85/month. Rates increase with age—seniors over 70 may pay $100–$130+/month depending on health.

Q: Will my rates ever increase?

A: No. Final Expense insurance is a whole life policy, so your rates are locked in for life, your coverage won’t decrease, and your policy won’t expire as long as premiums are paid.